When to Invest in Crypto Mining? Is There Ever a Good or Bad Time?

With huge market fluctuations recently and ETH 2.0 coming, is there ever a good time to start crypto mining. Here's our take...Is There Ever a Good or Bad Time to Invest in Crypto Mining?

In this article, we’ll explore the question of whether there is ever a good time to invest in crypto mining?

I’ve been thinking about this a lot lately. The fact that you are on this page probably means that you are interested in crypto mining but have doubts.

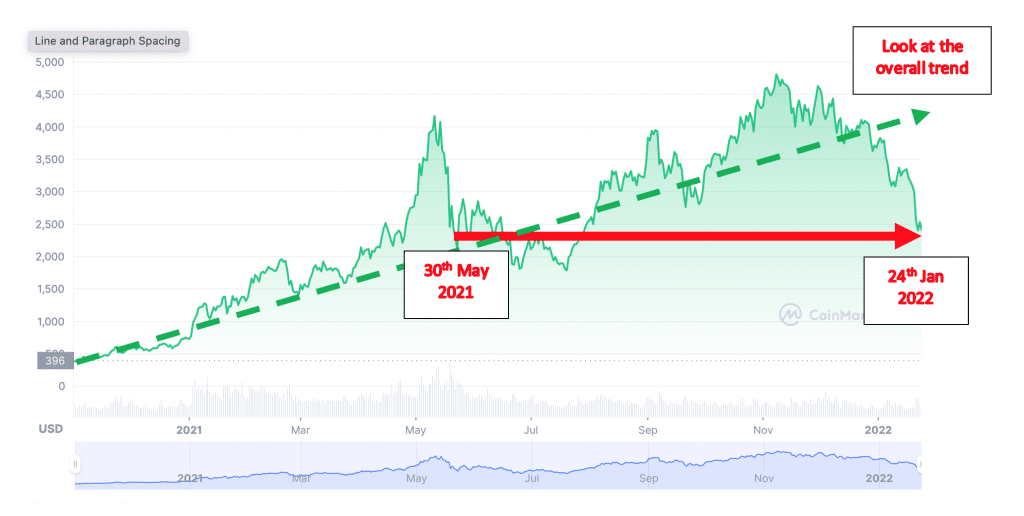

Right now, the USD price of Ethereum for example is roughly the exact same price as it was on 30th May 2021 when fear of crypto was extrebutmely high. Only 6 weeks prior to this, Ethereum was at an “All Time High” but prices across the market suddenly plummeted after Elon Musk’s announcement that Tesla would stop taking Bitcoin payments on May 12th 2021.

We are now in January of 2022 and it seems that many people are again questioning cryptocurrencies and crypto mining in general. This time, it’s mainly due to news reports causing significant market turbulence, but even before that, the future transition of Ethereum from Proof of Work to Proof of Stake (ETH 2.0) was causing potential investors to question whether crypto mining is worthwhile. Let’s discuss each of these concerns briefly…

Crypto market turbulence in 2022

We’ve had one of the most turbulent weeks in history, with the entire crypto market seeing a huge decline. Even Bitcoin which is normally more resistant to turbulence has seen more than a 15% drop in a single week. Ethereum is down roughly 25% and some of the newer meta cryptocurrencies like Decentraland and Sandbox are down over 30%. But, why is this happening? Well, there are a number of possible reasons, but I’ll share the top two reasons here.

News reports of central banks banning crypto mining

The first is news that the Russian Central Bank is seeking to ban crypto mining. I won’t delve into that here, but it’s not the first time we have had this kind of news. There have been repeated news reports of China banning crypto mining over the years. Considering how often news like this is reported, especially for China, it becomes almost normal to those of us who have been involved in crypto for long enough. Reports like these always seem conveniently timed to manipulate the market into a downturn, then more often than not, they are followed by a bull run.

Expectations of “hawkish” Federal Reserve minutes

The Federal Reserve meeting in December really seems to have spooked markets and Wallstreet, especially where riskier assets such as tech and crypto are concerned. The latest crypto decline comes following the release of the meeting minutes. You can read more about this here: https://www.cnbc.com/2022/01/06/bitcoin-btc-slides-cryptocurrencies-drop-on-hawkish-fed-minutes.html

COVID-19 and the Omicron variant

It may come as no surprise, but COVID has also played a key role in the crypto market, well the financial markets in general. With fears of ongoing lockdowns and new variants, the news continues to be ripe with fear. This in turn has a knock-on effect and can significantly impact financial markets such as crypto.

Ever since news emerged of the Omicron variant in December 2021, the market has been in a downward trend. This followed by further negative news such as the Fed minutes and Russian ban on crypto mining only amplifies the downturn.

Does any of this matter and should you still invest in crypto mining?

Well, it doesn’t matter to us and I will tell you why

As a family and business, we not only sell crypto mining rigs to other business, but we have personally invested in many mining rigs and we have also invested in cryptocurrencies directly using different exchanges. We do this because we are big believers in Blockchain and crypto as a whole. For us, it’s not about quick-term day trading or gains, it’s about the long haul and making sure we HODL (Hold On For Deal Life).

It’s of course natural to feel disheartened when you see crypto prices drop, but for us, right now is a huge buying opportunity. As believers in crypto, nothing has changed as a result of recent news. The fundamentals for crypto are just as solid as they ever were. Given recent drops reaching as high as 15-40%, our view is that many leading cryptocurrencies like Bitcoin, Ethereum and Cardano are an absolute bargain right now. So instead of panicking and running away, we are investing in crypto mining.

Unfortunately, this is where many newcomers and traders often make huge mistakes. It’s human nature to get caught up in the excitement of getting rich quick – and there is nothing more exciting than watching Bitcoin go one of its parabolic rallies. However, it’s impossible to time the market and this often leads people to buy at the top due to FOMO (Fear of Missing Out). The opposite is also true. When the market takes a downturn like it is now, fear kicks in and it’s natural to panic, but this leads people to sell and make a loss.

This is why we would always advise you HODL, remember why you invested in the first place and not get caught up in negative news.

What about mining? Surely we’ll be losing money?

Mining crypto is no different. It’s just another way to invest in crypto, so all the same principles apply.

We always see more interest in our rigs when the bitcoin looks as though it’s going to the moon. During downturns, like the one we are in right now, interest seems to vanish. The thing is, most asset classes are volatile to some degree. Whether investing in stocks/shares, gold, property or cryptocurrencies, there will be highs and lows.

The first thing to realise is that both positive and negative news will impact the prices listed on exchanges like Coinbase or Binance. Therefore if you use an exchange to store your mined crypto, you will most likely know your Fiat balance off-by-heart and feel discouraged to see it decreasing.

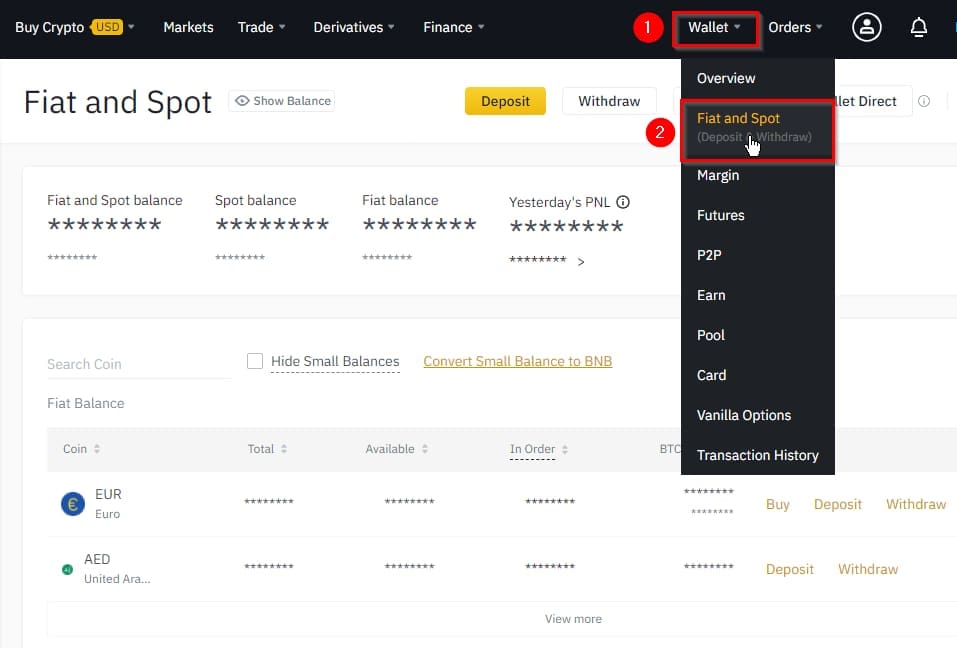

Taking Binance for example, below shows how to access the Wallet and Fiat and Spot balance:

An example of a Binance account

But just because your Fiat balance is down by 25%, does that mean you’ve actually lost 25%? No.

You’ll only lose if you decide to sell

You only lose or profit at the point you decide to sell or buy. When in doubt, all you need to do is look at the price chart for most mainstream cryptocurrencies (Bitcoin for example), zoom out and view the data over a period of years. It’s hard to find a single cryptocurrency making a loss over longer timeframes.

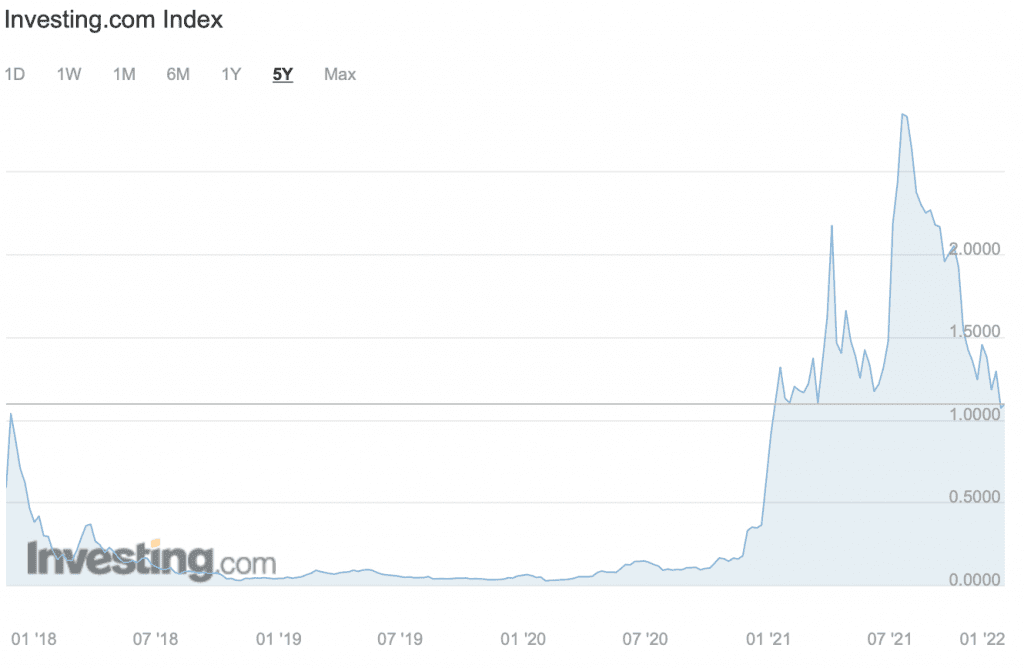

Cardano (ADA) for example is down over 15% in the last month but up by 214.46% in one year and 2492.49% over three years.

Cardano – a compelling example of a good investment in crypto over a period of years

This is just one example and there are many more compelling cases just like this.

Will negative news have a negative impact on crypto mining?

It’s important to realise that negative news doesn’t necessarily have a negative impact on actual mining or the amount of crypto you are earning. Of course, it matters very much if you decide to panic, sell and make a loss. But, providing you continue to mine and deposit your earnings as normal, then very little changes and your crypto balance will continue to grow.

What if other miners stop mining?

It’s possible that other miners may panic and decide to pack up mining completely. That could potentially impact the level of competition/difficulty and mining rewards for other miners, but that’s not a bad thing for those in it for the long haul. When enough people stop mining, competition decreases and profitability increases for the rest of us. So don’t let that put you off – one person’s loss is another person’s gain!

A profit or loss comparison between somebody who panic sells vs holding

So, going back to crypto mining, what does all this mean? Well, no matter whether crypto prices are going sky high or dropping, you will continue to build your crypto wealth with each payout.

For example:

One of our 1000 crypto mining rigs, mining Ethereum will currently generate around 0.015 ETH per day. At today’s price, the rig costs £28,000 plus VAT.

Scenario 1 – selling when Tesla stops taking Bitcoin payments in 2021

Somebody who purchased a rig at the start of January 2021 when Bitcoin (and the rest of the market) was on the way up and panic sold 4 months later due to May 2021 price collapse following Elon Musk’s announcement that Tesla will no longer take Bitcoin payments.

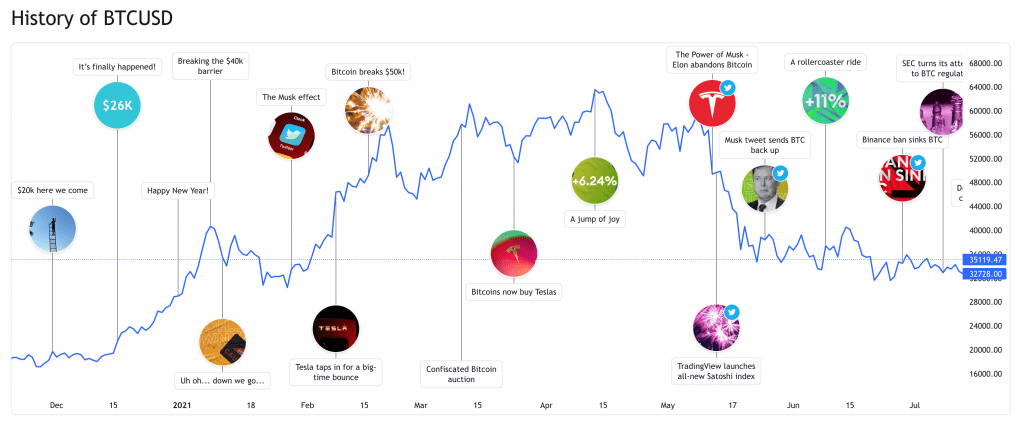

Let’s take a hypothetical look at the chart below and assume that somebody decides to buy their crypto mining rig at the start of January 2021. Bitcoin was about to make its ascent to new “All Time Highs”.

In this scenario, we are mining Ethereum but we look primarily at Bitcoin as this tends to lead the way and all other cryptocurrencies generally follow Bitcoin when there is positive or negative news. I’ll also be making some assumptions, the largest being that the level of difficulty/competition and daily mining rewards remain the same. I will also be excluding electricity costs and any other fees to keep the calculations simple.

Important events for Bitcoin’s through to mid-2021.

- On Jan 1st 2021, Ethereum was priced roughly at $730.

- ETH prices had been increasing nicely so “Investor A” decides to buy a 1000 MH rig from us for £28,000.

- Each day, Investor A earns 0.015 ETH.

- ETH goes on a huge bull run at hits a new “All Time High” on 11th May of roughly $4,168. It’s grown 6X – wow.

- But then, when it seemed like the growth would continue forever, on May 12th Elon Musk announces that Tesla will stop taking Bitcoin payments due to environmental concerns.

- In the space of 18 days following this news, ETH drops to $2,390 on 30th May 2021, a 43% drop from the All Time High.

- Fear is at an all time low with the Fear and Greed Index reporting Fear at 10, meaning Extreme Fear. To put this into perspective, 100 on the other hand would be Extreme Greed and I believe 10 is the lowest the index has ever gone.

- Investor A loses faith, panic sells their rig and cashes out on their ETH.

- Investor A has been mining for 149 days and has earned 2.235 ETH, with each ETH worth $2,390.

- They withdraw a total of $5,341.65 (£3,945.78 at today’s rate). They sell the rig at a time when the market is in Extreme Fear and only recoup 70% of its original value at £19,600.

- With a total GBP returned of £23,545.78, Investor A feels lucky that they have only lost £4,454.22

But, remember the price of ETH only matters when you decide to sell!

Scenario 2 – somebody who purchased at the same time but decides to HODL

Somebody purchases the same rig and the exact same time but they decide to ignore all news and HODL all the way through to today’s date, 24th January 2022.

“Investor B” continues to mine every day, putting the turbulence and volatility of the market to one side and effectively Dollar Cost Averaging, (or should I say Ethereum Cost Averaging) their wealth through the highs and lows.

- Each day, Investor B earns 0.015 ETH.

- They ignore any news from Elon Musk and other sources, including bans in China and Russia.

- Investor B looks the other way when the market is in Extreme Fear and continues to believe in the fundamentals of crypto.

- As of today’s date, Investor B has been mining for 388 days and has earned 5.82 ETH, with each ETH worth $2,400.

- They currently hold a total of $13,968 (£10,320 at today’s rate). During this time, very few new GPUs have come onto the market, miners have purchased what there is available and supply has dried up, pushing demand and prices up. The rig is actually worth more today than on 30th May. However, Investor B doesn’t sell the rig as the market is in Extreme Fear once again.

- Their current wealth from this investment is estimated to be £10,320 of ETH + the expected retail price of the rig. To be conservative, we will say the rig could sell for 70% of its original value at £19,600.

- Therefore the total wealth is £29,920. Investor B feels lucky that they are technically making a profit of £1,920. However, this doesn’t matter to them as they plan on only selling in several years time when the market is in Extreme Greed and they can make maximum profits from selling their rig and crypto.

Buy, here’s the big shocker! The price of ETH is virtually identical today to the price back on May 30th 2021 at roughly $2,400. The Fear and Greed Index is at 13 today, only slightly higher than May 30th. We’ve seen some bull runs and bear runs in between, but user psychology right now is about the same as it was then.

Ethereum price difference between 30th May 2021 and January 24th 2022

Obviously, this is just a very crude comparison and doesn’t take into account variables or other factors, but it demonstrates the point.

Will ETH 2.0 kill crypto mining? No.

For years, there has been talk of the ETH 2.0 update, meaning Ethereum would move away from Proof of Work to Proof of Stake. In layman’s terms, this simply means that conventional computer or GPU mining can no longer be used to acquire Ethereum directly. Instead, this is done through ETH staking.

When ETH moves to ETH 2.0, it will become unmineable, but this is by no means the end of crypto mining and I’ll explain more below…

Many are expecting that ETH 2.0 will be rolled out during mid-2022 and are fearing “the death of crypto mining” but it’s important not to get caught up in any kind of fear and consider some important points.

Firstly – and most importantly, we can’t predict the future. But, let’s look at a few options:

- ETH 2.0 has been plagued with delays and it may very well be delayed again

- Any ETH you mine now can stay stored in your wallet/exchange once ETH 2.0 is rolled out, meaning you can still benefit from future price increases

- You can continue to simply invest in ETH 2.0 directly by staking

- Ethereum isn’t the only cryptocurrency minable with GPU – You could switch your crypto mining to other profitable coins, such as Firo, Ergo, Raven Coin, Flux or even Ethereum Classic. See here – https://whattomine.com/coins

- When ETH 2.0 is here, you can always convert other mined cryptocurrencies into ETH

- This may come as a surprise, but there are other ways to mine crypto as well. Proof of Work is one of the main methods used by GPU and ASIC miners, but there are other methods. A good example is Proof of Coverage which is used on the Helium Blockchain to mine HNT.

As I mentioned above, we can’t foresee the future, but I can’t see a future where cryptocurrencies can’t be mined.

You may even decide to mix and match the coins that you mine/store, it’s always a sensible strategy to diversify. The important bit is that you are continuing to effectively Dollar Cost Average and build your crypto wealth gradually over time.

Moral of the story? Is there ever a good or bad time to invest in crypto mining?

Crypto mining will continue to live on, but it’s a significant investment so I would ask you to do the research.

I recall somebody describing blockchain and cryptocurrency as a new digital superhighway. He made the analogy between the United States superhighway which was constructed in the 1950s. Imagine if you had been able to create/own some of that superhighway. What if you had sold it back in the 1950s and what would that be worth today?

Unfortunately, you’ve missed the boat on that one. But you have the opportunity to get involved and participate in the creation of this future digital superhighway whilst at the same time getting a stake/share of your own.

If we go back to the comparison, who’s better off, Investor A or Investor B? Hopefully, that’s obvious. Investor B technically is making a profit, but more importantly, they have not made a loss because they have not sold. Instead, they have decided to HODL.

What’s more, look at the chart above. Clearly, the current price of ETH is roughly the same now as it was back on 30th May 2021 but look at the overall trend. It’s clear that the trend is upwards and I would argue that ETH is severely undervalued right now and a real bargain for any miners and investors. If we were to follow the trend, the price of ETH would be between $4,000 and $4,500 right now.

Imagine, if we weren’t living in a world of negative news (COVID, crypto bans, etc.), it’s quite feasible that Investor B would be holding 5.82 ETH, with each ETH worth $4,250. That would give them a total of $24,735 USD or £18,282 GBP in ETH rather than £10,320.

With the USD price of Ethereum predicted to reach over $12,000 by January 2025, you can easily see the benefits of ignoring negative news and holding.

The current price, whether up or down, really doesn’t matter if you believe in the fundamentals of crypto. Don’t try to time the market. All you need to do is mine your crypto and HODL. Never invest or spend more than you can afford to lose, that way you will never be forced to sell at the wrong time. But, if you have the means, you can expand your capacity to mine even more by incorporating additional rigs as your confidence grows. Or for those on a budget, you can always take a percentage of your mined profits when the time is right, to invest in crypto mining and expand your capacity at a later stage.

The moral of the story is that there is ALWAYS a good time to invest in crypto mining.

Image credits – https://www.tradingview.com

Last modified on: April 23, 2024

Latest Posts

Basic Economics & Cryptocurrency Valuation

Why I've Written This Article? One of the most common, and most frustrating, objections (misconceptions) that I hear...

About CryptosRUs and Into the Cryptoverse

This post exploring CryptosRUs vs Into the Cryptoverse for free crypto advice is a little different to others we...

From Everyday People & General Adoption to the Bitcoin Elites: Who Will Benefit the Most?

IntroductionOn 6th September 2023, we published a massive article titled ‘Detailed Analysis of Projected Bitcoin...

How The Price of Bitcoin is Impacted by External Drivers & Forces

Introduction On 6th September 2023, we published a massive 10K word article titled ‘Detailed Analysis of Projected...

Contact us to order your crypto mining rig today

Address

Opace Ltd, Park House, Bristol Rd South, Rubery, Birmingham, West Midlands, B45 9AH. United Kingdom.

crypto@opace.co.uk

Phone

0845 017 7661

Who needs crypto mining when we can just trade our toilet paper for Bitcoin? 💩🪙

Everybody is entitled to their opinion but I would suggest doing research before making such claims.