Cryptocurrency vs Fiat Currency

With so much crypto volatility, will we ever be able to use cryptocurrencies like Bitcoin as a real-world currency?Cryptocurrency volatility: will crypto ever be suitable as a replacement for Fiat currency?

Bitcoin along with most cryptocurrencies have seen a significant price increase against the USD over the last couple of weeks followed by a sudden drop over the last couple of days, most likely due to concerns over Russia invading Ukraine.

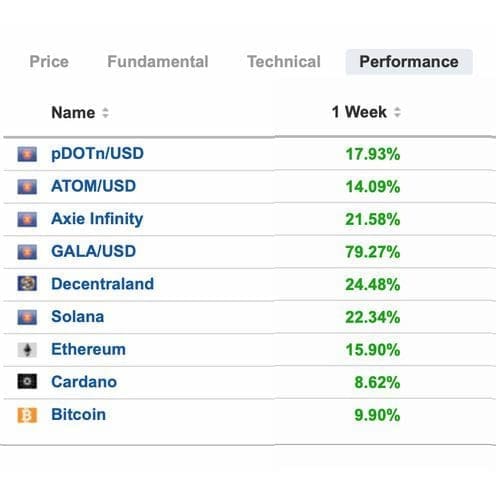

Ethereum recently shot up over 15%, many others, including several metaverse cryptocurrencies, are up much more than that..

Investing.com Performance tracker showing sample cryptocurrencies and their price against the USD.

Does crypto volatility mean it can’t be used as a real-world currency?

We had an interesting debate recently when the prices started spiking. The comment was made below:

“There’s way waaaaay too volatile to use for anything other than speculative investing. It couldn’t be used as a fiat replacement with it like this”

But is this thinking about it the wrong way?

Cryptocurrency vs Fiat currency

If you are defining any cryptocurrency value by its link to a Fiat valuation, such as the USD, then its price will appear to be volatile, especially when there is so much happening in the world.

From COVID-19, to mining bans in China, concerns over inflation, and most recently, the news that Russia may invade Ukraine, it does indeed seem that crypto volatility is far too risky for it to ever be viewed as a valid replacement for Fiat currency.

However, this is is because we think of crypto in terms of its relative Fiat value, usually measured in USD or GBP in the UK.

Satoshis

Let’s talk about Satoshis.

You might be asking, “what on earth is a Satoshi?”

The answer is quite simple, it’s a unit of measure like any other. To be precise, it is the smallest unit of a Bitcoin and equal to 1 Bitcoin divided by 100,000,000, i.e. 0.00000001 BTC. Or to put it another way:

- 1 Satoshi = 0,00000001 Bitcoin

- 1 Bitcoin = 100,000,000 Satoshis

This is no different to the UK pound which is divisible by 100 pence; however in this case, a Bitcoin is divisible by 100,000,000 Satoshis.

Therefore 3,000 Satoshis has always been 3,000 Satoshis. 1 Bitcoin has always been 1 Bitcoin.

It’s only a cryptocurrency’s value relative to Fiat that changes, meaning if you’re using BTC as a currency, none of the Fait trading pairs (USD, GBP, etc.) should matter in principle.

Currency inflation

You might say ‘”But isn’t the same principle true about the US Dollar? A US Dollar now is still the same as a Dollar 10, 20 years ago right?”

You can see how easy it is to think this, but it’s not the same.

This is because there will only ever be a maximum circulation of 21 million Bitcoin. That can’t be said for the US Dollar or any Fiat currency, as they are not backed by the gold standard anymore.

The gold standard provided a way of linking Fiat currencies to a tangible asset, something that had a limited physical supply and value that could be traded anywhere in the world.

With the gold standard gone, the number of US Dollars in circulation began to increase in a never-ending fashion, with new money being printed all of the time. It’s not just US Dollars, countries all around the world are printing new money (known as quantitative easing) as a way to stabilise the economy.

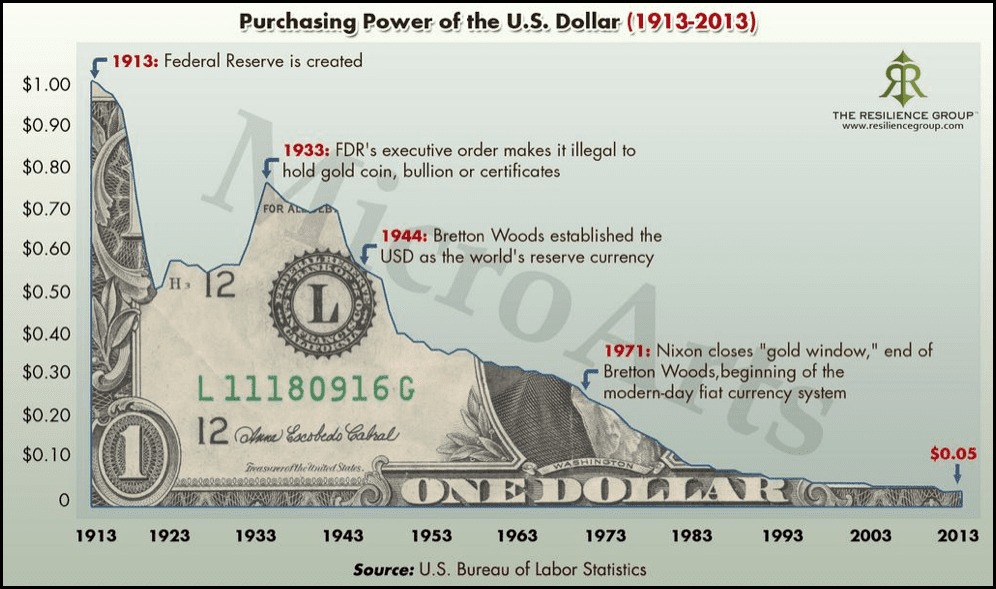

The decreasing purchasing power of the US Dollar over the last 100 years

This is the problem with Fiat currency and the financial world in general right now. Printing money is a short-term solution to solve economic concerns with long-term and disastrous side effects.

Deflation, CPI and interest rate hikes

The USD and other Fiat currencies like the GBP are failing, they are losing vast amounts of their value without many of us even realising.

Recent CPI reports showing that US inflation has surged to 7.5%, the fastest annual rise for 40 years, is very worrying. We’re not immune to it here in the UK either. The UK, like many other western countries, are suffering from inflation and being forced to raise interest rates as a means to combat this.

Prices are going up, interest rates are being hiked and our Fiat currencies are quickly becoming worth less and less, with their purchasing power diminishing.

But I’ve heard Bitcoin is a scam?

Let’s look at the problem of inflation in more detail.

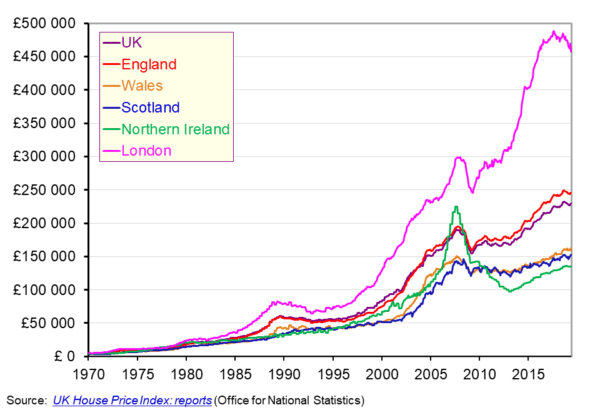

In 1980, the average house value in England was just over £23,287. Today, that same house price is over £250,000. That’s more than 10 times more. Is the average person living in the UK earning 10 times more? No.

UK house price index

This is the impact of inflation caused by traditional Fiat currencies and quantitative easing.

If that’s not a scam, what is it? In some ways, it’s the biggest scam in history.

Fiat currencies are no longer backed by gold, so they have no intrinsic value. And worse, Fiat currencies lose their value every year. It only has value because we perceive it that way, but in reality, it’s worth no more than the paper it’s printed on. More importantly, we have no choice other than to accept its declining value because there is no viable alternative right now.

Bitcoin on the other hand is deflationary. Sure, we can make the same arguments about its intrinsic value and there will be people on both sides of the argument depending on how you view “value”. But you cannot argue that it will suffer the same fait as Fiat due to inflation.

So is Bitcoin a scam? No – and it’s certainly no more of a scam than the paper money you hold in your wallet or electronic money on your credit card.

Bitcoin price increases and decreases are an illusion

It’s deceptive when people say Bitcoin went up in value by 10% or down by 10% as that change is only relative to Fiat currencies such as the USD, GBP etc. Bitcoin itself stays static.

Investors have a tendency to watch their crypto portfolios and see USD price charts showing their holdings increase and decrease in a volatile fashion.

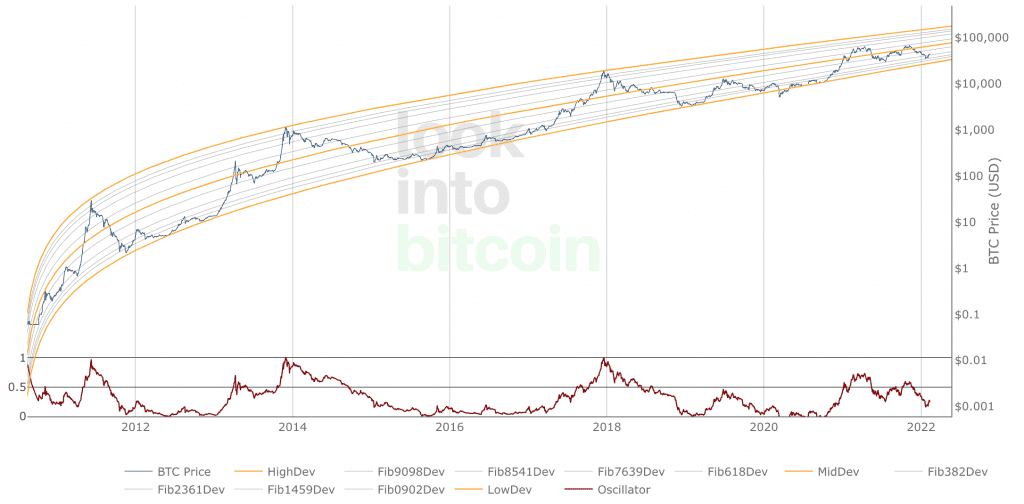

Bitcoin to USD Logarithmic Growth Chart – image credit – https://www.lookintobitcoin.com

The chart above shows a significant upward trend in the USD price of Bitcoin. However, these price changes are in some ways an illusion.

They are more of a reflection on the value of Fiat and events taking place in the world, as opposed to the actual value of Bitcoin. The important point to remember here is that the Fiat value of your Bitcoin only matters if you decide to sell.

Until then, 1 Bitcoin is still 1 Bitcoin. As a deflationary currency, the value of that Bitcoin can not be inflated, and as any investor will know, the trick is to hold.

If you wanted to get a more realistic measure of Bitcoin’s value, we can compare the Bitcoin to Gold ratio. Both have a fixed supply, a perceived value are not subject to inflation. The chart below divides shows the number of ounces of gold it would take to buy a single Bitcoin and tracks that price over 10 years.

Bitcoin to Gold Ratio – number of ounces of gold to buy a single Bitcoin. Image credit – https://www.longtermtrends.net

As can be seen, Bitcoin has steadily but very definitely outperformed gold as a store of value, with more physical gold needed to purchase Bitcoin over time. For me personally, this is a lot more reassuring than seeing the price of Bitcoin grow against the USD.

Countries adopting crypto as legal tender

Look at El Salvador, the first country to recognise Bitcoin as legal tender. In some ways, they are ahead of the times, but not for the reason you may think.

Yes, they’ve adopted Bitcoin as legal tender before any other country, but they, like us, were suffering from inflation.

If inflation continues, this can lead to hyperinflation, which is exactly the case in Lebanon. Fixed supply cryptocurrencies like Bitcoin do not suffer this same fate and may provide a solution for many countries suffering from high inflation as it becomes more accepted.

The only time the trading price impacts El Salvador is if they’re trading Bitcoin for USD or another currency, but why would they want to do that given everything we have discussed above. They would effectively be trading a deflationary currency (Bitcoin) for an inflationary currency (the USD).

There has even been recent news that Russia may also move to recognise crypto as a currency. This seems in complete contrast to recent news claiming that Russia is banning crypto mining, so for now at least, it needs to be taken with a pinch of salt.

However, there is no doubt that 2021 and 2022 will be remembered for the years that the world started to wake up and view cryptocurrencies like Bitcoin as actual currencies.

Conclusion: is Bitcoin a viable replacement for Fiat currency?

There are of course other arguments to be made about the suitability of Bitcoin and other cryptocurrencies as a replacement for Fiat.

In our opinion “volatility” isn’t a valid reason, but there are genuine concerns, such as transaction speeds, environmental worries and various other technical limitations which we will discuss another day. For this reason, we don’t think it’s a viable replacement for Fiat currency at the moment.

That said, for investors or even your average person looking to save or preserve their wealth, it is a great store of value when being used as an asset class like gold. It’s certainly a safer and better store of value than Fiat currencies.

Just remember, crypto is only volatile because we look at it through the lens of it being used to redeem Fiat currencies. 2,000 satoshis in a wallet today, is still the same as 2,000 satoshis in a wallet from 2017. The only difference is the Fiat valuation.

If we ever move to BTC as a traditional currency, its Fiat value probably wouldn’t matter anyway.

Last modified on: April 23, 2024

Latest Posts

Basic Economics & Cryptocurrency Valuation

Why I've Written This Article? One of the most common, and most frustrating, objections (misconceptions) that I hear...

About CryptosRUs and Into the Cryptoverse

This post exploring CryptosRUs vs Into the Cryptoverse for free crypto advice is a little different to others we...

From Everyday People & General Adoption to the Bitcoin Elites: Who Will Benefit the Most?

IntroductionOn 6th September 2023, we published a massive article titled ‘Detailed Analysis of Projected Bitcoin...

How The Price of Bitcoin is Impacted by External Drivers & Forces

Introduction On 6th September 2023, we published a massive 10K word article titled ‘Detailed Analysis of Projected...

Contact us to order your crypto mining rig today

Address

Opace Ltd, Park House, Bristol Rd South, Rubery, Birmingham, West Midlands, B45 9AH. United Kingdom.

crypto@opace.co.uk

Phone

0845 017 7661