Benefits & Advantages of Cryptocurrency

Introduction to the Bitcoin explaining the benefits and advantages of cryptocurrencies over Fiat moneyBenefits & Advantages of Cryptocurrency Over Fiat

Why does crypto have value and how does this compare to Fiat money?

As the world becomes more digital and virtual, Cryptocurrencies like Bitcoin and digital currencies are the next stage in the evolution away from traditional Fiat currency. There are many advantages of cryptocurrency over FIAT and reasons why it is considered to be a valuable asset to own.

Having a limited supply means Bitcoin is often classed as “digital gold”

For example, the world’s first cryptocurrency, Bitcoin, has a limited supply and often gets compared to precious metals like gold that are also in limited supply. But why is a limited supply good?

Both Bitcoin and precious metals have real-world applications and uses which make them valuable:

- Precious metals are considered a luxury item and are often used in jewelry but also have value in industrial applications and component manufacturing.

- Bitcoin’s blockchain technology means it has a valuable role to play in the financial system. More on this below.

Other cryptocurrencies play different roles, but they all tend to have similar characteristics, often having a limited supply and applications which make them useful.

How is Bitcoin different from FIAT?

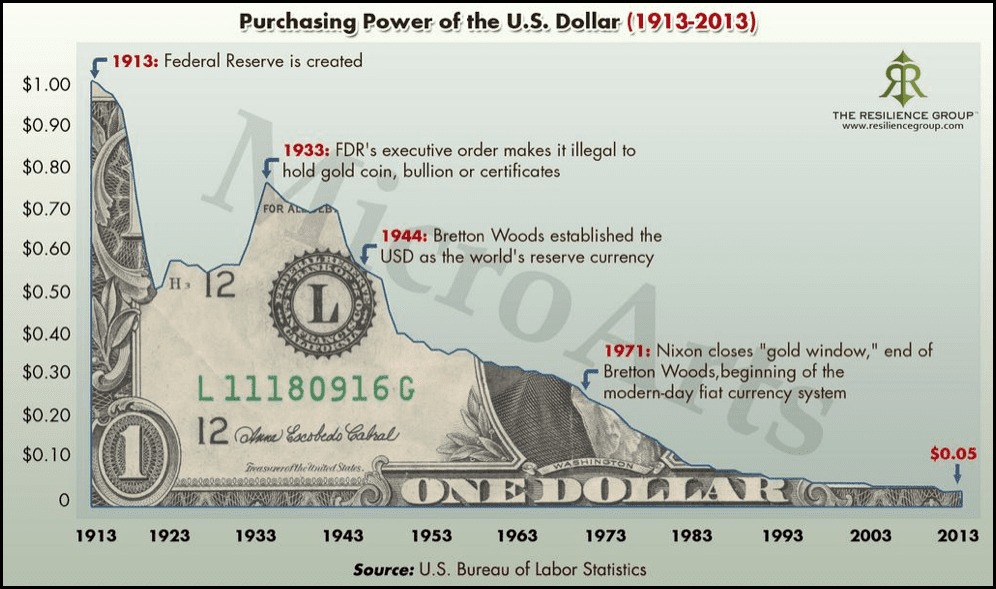

Fiat on the other hand is money and has no intrinsic value these days. This was different back when Fiat was backed by gold (the “gold standard”) as its value was measured in (and backed by) gold. Ever since the gold standard was abolished, the value of Fiat has been in the hands of governments, and whilst it has a perceived value, its intrinsic value is no more than the paper it has been written on.

Fiat is also subject to quantitative easing (increasing the supply of money) often to help combat a financial crisis. This has the overall effect of keeping the economy safe but also lowers the value of the money in circulation and often causes an increase in inflation, meaning our traditional Fiat currency (or cash) becomes worth less than it did previously.

The decreasing purchasing power of the US Dollar over the last 100n years

Bitcoin on the other hand is not only limited in its supply, but it also has a halving event where the reward for mining Bitcoin is reduced by half. This in turn halves Bitcoin’s inflation rate and halves the circulation of any new bitcoins.

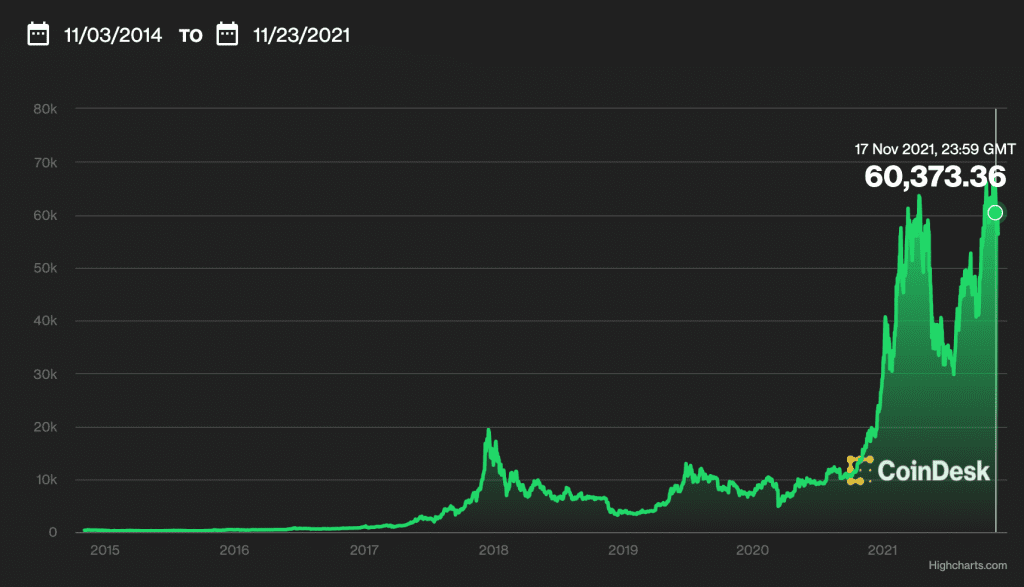

For this reason, cryptocurrencies like Bitcoin are often purchased as a way to combat inflation as well as for their intrinsic value and growth potential. Whilst Bitcoin isn’t technically deflationary, it’s clear to see the price of each Bitcoin compared to the US Dollar is clearly growing with time – and at an exceptional rate.

Bitcoin to US dollar chart showing the growth in Bitcoin price since 2014

Other advantages of cryptocurrency over traditional FIAT

Currently, the financial sector across the world relies on other trusted third parties to maintain a comprehensive record of all financial transactions. For instance, when one does any transaction at the bank, their system maintains a record of the transaction. Intermediaries like PayPal, banks and other key players of the current financial system play a significant role in regulating global financial transactions. However, the important role that these third-parties play also has several challenges and limitations.

Limitations of the current financial system

Let’s quickly dive into the challenges:

- Unfair capture of value: intermediaries like PayPal amass billions in the wealth creation process (the market cap for PayPal is $130B), but they do not pass any value to their consumers

- Fees: parties facilitating the financial transaction usually charge fees

- Censorships: intermediaries can place limitations or restrictions on the movement of money

- Act as gate-keepers: intermediaries serve the role of preventing others from being part of the network

- Powers to disclose information: in the event of a security threat, they may disclose or be forced to disclose financial information about their users

How does Bitcoin solve these global challenges?

So, how does Bitcoin solve the challenges concerning intermediaries in the financial sector? In 2009, a group of programmers (or an individual programmer) under the name Satoshi Nakamoto launched a peer-to-peer digital cash system called Bitcoin. Bitcoin went on revolutionise the entire financial system by bringing in “freedom of money”.

Bitcoin, as well as being a store of value, for the very first time in history allowed individuals all over the world to exchange value on its secure blockchain system without any other third parties or intermediaries being involved. Bitcoin ensured that common people could directly pay each other directly, bypassing institutions, obstructions and third-party fees.

Blockchain: the secret behind Bitcoin’s success

Bitcoin’s breakthrough is attributed to blockchain technology. Despite all financial records being maintained by the Bitcoin community, blockchain technology ensures that the entire community always reaches a consensus on legitimate, truthful and accurate transactions.

This ensures that fraudulent and false transactions can never take place through the cryptocurrency system, allowing blockchain technology to bypass the need for intermediaries without compromising basic financial transaction security.

How does all this work?

If you are still wondering how this works and why it provides a better system, read on:

- Cryptocurrencies are held in digital cryptographic wallets that are secured by strong passwords known as private keys

- The private key is responsible for cryptographically signing transactions and one can’t create fake signatures

- This creates unsuitability and security and even government authorities cannot access one’s funds

- Cryptocurrencies are resistant to any form of censorship because they are decentralized and any user can submit a transaction to a computer within the network for validation or recording

- They are immutable and every transaction block represents a “hash” or cryptographic proof

- There are no bouncing checks and if one sends money to you they cannot reverse the transaction

Are there any limitations of cryptocurrencies like Bitcoin?

During the early stages of Bitcoin, a few users were working together in mining the very first blocks and validating BTC transactions by operating BTC mining software on their PC. But as more and more users started mining Bitcoin, the level of competition and ambition increased, meaning more powerful mining computers were needed to continue earning Bitcoin.

This led to the invention of specialist “ASIC” computers for mining Bitcoin and the Bitcoin Gold Rush began, making it extremely difficult for ordinary people to contribute and benefit from Bitcoin mining. ASICs have also contributed to significant environmental concerns because they consume large amounts of energy and computing power due fulfill their role.

These days, the only real options users have to own Bitcoin are to:

- Start mining it: buy expensive ASIC miners (not forgetting the electricity and energy costs required)

- Buying on exchange platforms: as of today (5th November 2021) the price of 1 unit of Bitcoin is $61,615.4/per coin but luckily you can buy a very small fraction of Bitcoin to get started

Alternatively, you can look further afield and consider alternative cryptocurrencies to mine. Currently, Ethereum is a popular choice as it’s more profitable than Bitcoin and can be mined using standard computer systems, GPU rigs, and of course, ASIC miners. Lots of other popular cryptocurrencies like Ravencoin, Litecoin and Bitcoin Gold can also be mined.

Here at Opace, we always recommend investing in GPU miners – you can read more on this here: https://www.crypto-mining.co.uk/faqs/why-choose-gpu-mining-computers-over-asic-miners

Contact us about your crypto requirements

We are enthusiastic about all things crypto! Start your own crypto journey when you contact us. We have a range of crypto mining servers that will kickstart your cryptocurrency journey and allow you to take advantage of this phenomenal opportunity.

Last modified on: April 19, 2024

Latest Posts

Basic Economics & Cryptocurrency Valuation

Why I've Written This Article? One of the most common, and most frustrating, objections (misconceptions) that I hear...

About CryptosRUs and Into the Cryptoverse

This post exploring CryptosRUs vs Into the Cryptoverse for free crypto advice is a little different to others we...

From Everyday People & General Adoption to the Bitcoin Elites: Who Will Benefit the Most?

IntroductionOn 6th September 2023, we published a massive article titled ‘Detailed Analysis of Projected Bitcoin...

How The Price of Bitcoin is Impacted by External Drivers & Forces

Introduction On 6th September 2023, we published a massive 10K word article titled ‘Detailed Analysis of Projected...

Contact us to order your crypto mining rig today

Address

Opace Ltd, Park House, Bristol Rd South, Rubery, Birmingham, West Midlands, B45 9AH. United Kingdom.

crypto@opace.co.uk

Phone

0845 017 7661

Sure, crypto has some advantages, but can we really trust something intangible over tangible money?

There are always risks, so I would advise never to trust anything. But, in terms of money being tangible, is it really? It’s not backed by anything other than good faith so it’s raw value is the paper it’s printed on. Whether we think about paper money, gold, digital currency or crypto, it’s all down the the value we believe those things hold. Both gold and crypto have a limited supply unlike traditional fiat currency.